Sehubungan itu keseluruhan rangkaian sistem LHDNM meliputi EzHasil Bantuan Sara Hidup dan Bantuan Prihatin Nasional akan ditutup bagi tujuan penyelenggaran seperti berikut. B 2021 RESIDENT INDIVIDUAL WHO CARRIES ON BUSINESS 2021 YEAR OF ASSESSMENTForm BRETURN FORM OF LEMBAGA HASIL DALAM NEGERI MALAYSIA AN INDIVIDUAL RESIDENT WHO CARRIES ON BUSINESS 77 OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 CP4A - Pin.

How To Step By Step Income Tax E Filing Guide Imoney

Income tax return for individual who only received employment income.

. KUASA PEMFAILAN PENYATA SECARA ELEKTRONIK. Form B - income assessed under Section 4 a - 4 f of the ITA 1967 and be completed by individual residents who have business income sole proprietorship or partnership. Maklumat penghibur awam yang tidak bermastautin.

2021 N ame. 点击 Borang e-B 不是马来西亚居民却在马来西亚赚取收入的点击 Borang e-M. Registered with LHDNM Enter the last passport number filed with LHDNM prior to the current passport.

30062022 15072022 for e-filing 6. OG 5 Passport no. For the item Income tax no enter SG or OG followed by the income tax number in the box provided.

Sebelum mengisi borang e-Filing pengguna. Panduan Lengkap Cara Isi E-Filing Cukai Pendapatan Individu Borang BEB 2021. Pengiraan kami adalah berdasarkan gaji anda pada tahun 2020 dan 2021.

700 malam hingga 700 pagi. This form is pre Income tax no. Meanwhile if you did not register your business then use the usual BE form for those with non-business income to file your tax as a freelancer instead.

For Income tax no. Penilaian Cukai Tahun 2021 haruslah dilakukan selewat-lewatnya 30 April 2022. 3 Jalan 910 Seksyen 9 43650 Bandar Baru Bangi.

Non-resident public entertainers income tax no if already registered. Income tax return for partnership. Potong yang tidak berkenaan No.

Business income should be declared in the Form B. Borang yang ditetapkan di bawah Seksyen 152 Akta Cukai Pendapatan 1967 Form prescribed under Section 152 of the Income Tax Act 1967 CP 4 - Pin. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

Pembayaran balik cukai terlebih bayar pula dilakukan dalam tempoh dua 2 minggu setelah tarikh penghantaran. Key in the employees income tax number in this item. Borang B - pendapatan di bawah Sek 4a 4f Akta Cukai Pendapatan 1967 dan diisi oleh individu yang mempunyai punca pendapatan perniagaan t unggal atau perkongsian.

Then each subsequent Borang E filed for the rest of the employees should be numbered as 2 3 etc. This return if posted in Malaysia in an envelope marked Income Tax may be sent free of postage. 2 In accordance with the provision of the Income Tax Act 1967 ITA 1967 a limited liability partnership shall.

Lembaga Hasil Dalam Negeri Malaysia HASiL ingin memberikan peringatan kepada semua pembayar cukai yang tidak menjalankan perniagaan agar segera melaporkan pendapatan mereka yang layak. Borang perfoma b penghibur awam yang tidak bermastautin. 这一次我要跟大家说在大马报税 - Income Tax Cukai Pendapatan很多年轻人踏入社会后对报税 Income Tax 这两个字懵懵懂懂有些人不知道什么时候要报税有些人害怕报税有些人不知道如何报税不过报税不等于纳税.

In this form you will be able to declare your side income under Statutory income from interest discounts royalties pensions annuities other periodical payments and other gains and. BORANG PERMOHONAN NOMBOR PIN e-FILING BAGI FIRMA EJEN CUKAI. 02 April 2020 Khamis hingga 03 April 2020 Jumaat.

Identification passport no. This return i f posted in Malaysia in an envelope marked Income Tax may be sent free of postage. B LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF AN INDIVIDUAL RESIDENT WHO CARRIES ON BUSINESS UNDER SECTION 77 OF THE INCOME TAX ACT 1967.

FORM TN 2022 BUSINESS TRUST IMPORTANT REMINDER 1 Due date to furnish return form and pay the tax or balance of tax payable. Lembaga Hasil Dalam Negeri Malaysia Pusat Pemprosesan Maklumat Menara Hasil No. 30042022 15052022 for e-filing 5.

Can I declare my business income if I receive a Form BE. Identification Passport No. Notification under section 109a lembaga hasil dalam negeri malaysia nombor cukai pendapatan penghibur awam yang tidak bermastautin jika sudah berdaftar.

CP55A Dalam Format PDF CP55A Dalam Format Excel. B LEMBAGA HASIL DALAM NEGERI MALAYSIA BORANG NYATA INDIVIDU PEMASTAUTIN YANG MENJALANKAN PERNIAGAAN 7 AKTA CUKAI PENDAPATAN 1967 Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967 UT N ama. 上网登记账号 Register Income Tax.

Pengenalan pasport. For the item Income tax no enter SG or OG followed by the income tax number in the box provided. For Income tax no.

Pengenalan pasport. Income tax return for individual with business income income other than employment income Deadline. 2002STTS Female SAMPLE TAHUN TAKSIRAN.

Muat Turun Borang CP55 CP55A. This form is prescribed under section 152 of the Income Tax Act 1967 2019B YEAR OF ASSESSMENTForm CP4A - Amend. 1 - 4 Fill in relevant information only.

CP55 Dalam Format PDF CP55 Dalam Format Excel Borang ini boleh dimuat turun dan diguna pakai. Enter the full name of the employee as per his or her identity cardpassport. Borang yang ditetapkan di bawah Seksyen 152 Akta Cukai Pendapatan 1967 Form prescribed under Section 152 of the Income Tax Act 1967 CP 4 - Pin.

LAPORKAN PENDAPATAN TAHUN TAKSIRAN 2021 SELEWAT-LEWATNYA PADA 15 MEI 2022 DAN ELAK PENALTI LEWAT KEMUKA BORANG NYATA CUKAI. Headquarters of Inland Revenue Board Of Malaysia. Borang e-Filing boleh mula dilengkapkan mulai 1 haribulan Mac setiap tahun dan tarikh akhir adalah pada 30 April.

Pendapatan Isi Rumah. This Explanatory Notes is provided to assist an individual who is resident in Malaysia in accordance with the provision of section 7 of Income Tax Act 1967 ITA 1967 or deemed. OG 10234567080 Income tax no.

Accountant when come to Borang B Borang BE submission a common question may ask from your customers. 7 months from the close of accounting period. Malaysia Personal Tax Relief Income Tax Calculate this personal tax planner can calculate personal income tax in Malaysia key in the tax relief the tax amount tax bracket tax rate calculate automatic.

OG 10234567080 Income tax no. B LEMBAGA HASIL DALAM NEGERI MALAYSIA BORANG NYATA INDIVIDU PEMASTAUTIN YANG MENJALANKAN PERNIAGAAN DI BAWAH SEKSYEN 77 AKTA CUKAI PENDAPATAN 1967 Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967 CP4A - Pin. 2020 UT N ama.

Income other than business.

How To File Your Income Tax In Malaysia 2022 Ver

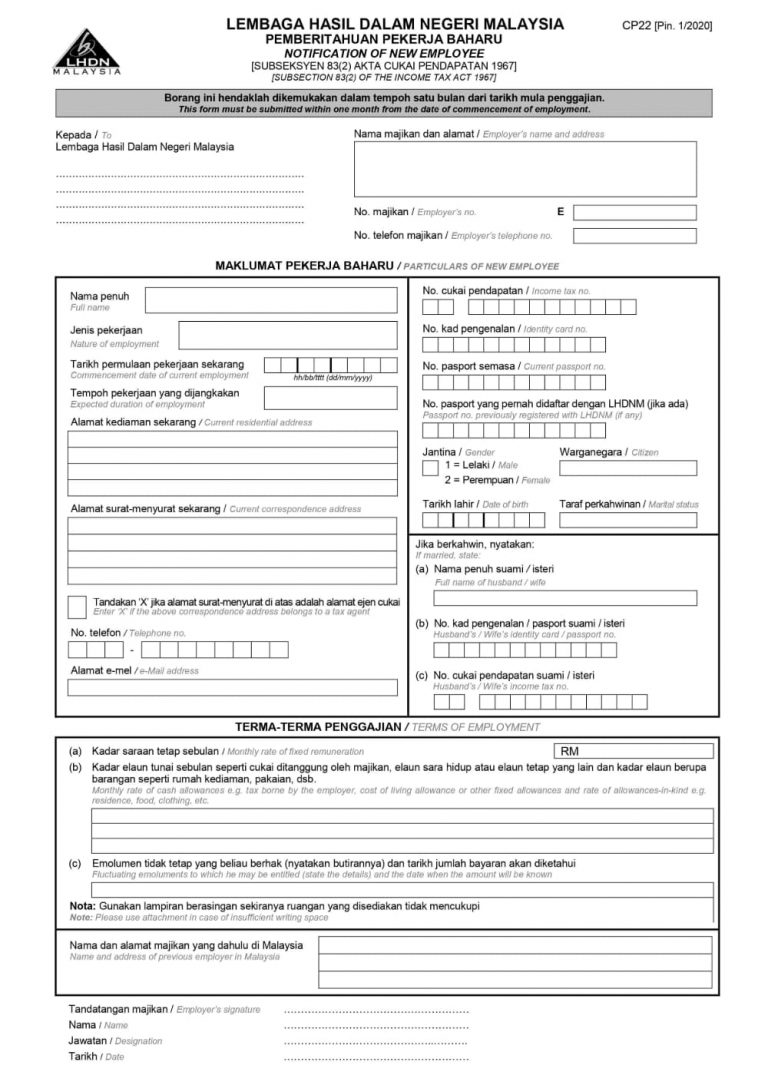

G G Human Resources Services What Is Form Cp22 Form Cp22 Is A Government Report That Is Issued By The Lhdn Cp22 Is A Notification Of New Employee Form An

How To File For Income Tax Online Auto Calculate For You

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To File Your Income Tax In Malaysia 2022 Ver

How To Step By Step Income Tax E Filing Guide Imoney

How To Step By Step Income Tax E Filing Guide Imoney

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Ktp 𝐇𝐚𝐯𝐞 𝐲𝐨𝐮 𝐂𝐏 𝟓𝟖 Everyone Know Form Ea For Sure Facebook

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

How To File For Income Tax Online Auto Calculate For You

Kenapa Kena Buat Land Search Land Search Ni Penting Utk Tahu Info Pasal Rumah Tanah Penjual Rumah Yg Anda Nak Beli Tu Sbb Tu First Sekali Inbox Screenshot

Siape Lagi Blom Hantar Borang Income Tax Korang Dah Hantar Ke Blom Borang Income Tax Utk 2017 Semua Da Nak Naik Bulan Mei Ni Tar Movies Movie Posters Smart

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

5 Tips For Sole Proprietors In Malaysia Lhdn Borang B Tax Filing Youtube

- kwsp i saraan

- gabungan nama adam anak islam

- lee kuan yew house

- arkib in english

- taman connaught mrt

- undefined

- borang b income tax malaysia

- fifa online 3 garena

- air panas cherana putih

- lukisan karton pengantin trasparent hitam putih

- batu akik hitam mengkilat

- ladang bawang putih malaysia

- klinik 1 malaysia penang

- sandwich telur viral

- kad kahwin sabah kota kinabalu

- tugas nabi dan rasul

- bank rakyat education loan

- soalan iq sbp

- syarikat air melaka berhad

- nama nama dewa olympus